Explore the highly anticipated IPO of Emcare Pharmaceutical Company, its strategic importance, market positioning, and growth potential. Discover how Emcare’s commitment to innovation and patient outcomes is poised to transform the future of healthcare.

In an industry marked by constant innovation and competitive drive, the pharmaceutical sector remains a cornerstone of modern healthcare. Emcare Pharmaceutical Company, a rising star in this domain, has recently made headlines with its highly anticipated Initial Public Offering (IPO). This milestone marks a significant moment not only for Emcare but also for investors and the broader healthcare market. This blog delves into the various facets of Emcare’s IPO, exploring its implications, the company’s background, and the broader market context.

Emcare Pharmaceutical Company: A Brief Overview

Emcare Pharmaceutical Company, founded in 2010, has swiftly carved out a niche in the highly competitive pharmaceutical landscape. Specializing in innovative drug development, Emcare has a diverse portfolio that includes treatments for chronic diseases, rare conditions, and groundbreaking advancements in biotechnology. With a commitment to improving patient outcomes and a strong focus on research and development, Emcare has earned a reputation for excellence and reliability.

The Road to IPO

The journey to an IPO is often long and complex, involving meticulous planning, regulatory scrutiny, and strategic decision-making. For Emcare, the road to its IPO was marked by several key milestones:

1. Robust Financial Performance: Over the past few years, Emcare has demonstrated robust financial growth, driven by successful product launches and strategic partnerships. The company’s revenue has consistently increased, underpinned by a strong pipeline of drugs in various stages of development.

2. Regulatory Approvals: Achieving regulatory approvals for its flagship drugs was a critical step for Emcare. These approvals not only validated the efficacy and safety of its products but also positioned the company for commercial success.

3. Strategic Partnerships: Emcare has forged strategic alliances with leading pharmaceutical companies and research institutions. These partnerships have facilitated the sharing of knowledge, resources, and technology, accelerating the development of innovative therapies.

4. Market Positioning: Emcare’s ability to identify and address unmet medical needs has been a cornerstone of its market strategy. By focusing on niche therapeutic areas with high demand and limited competition, the company has effectively positioned itself as a leader in those segments.

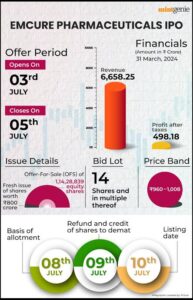

IPO Details

The Emcare Pharmaceutical IPO has generated considerable buzz among investors and analysts alike. Here are some of the key details:

1. Offering Size and Price: Emcare plans to issue 10 million shares at a price range of $25 to $30 per share. This would place the total offering size between $250 million and $300 million, depending on the final pricing.

2. Use of Proceeds: The funds raised from the IPO will primarily be used to further advance Emcare’s research and development efforts. A significant portion will also be allocated to expanding manufacturing capabilities and marketing new products.

3. Market Listing: Emcare is set to list on the New York Stock Exchange (NYSE) under the ticker symbol “EMC.” The choice of NYSE reflects the company’s ambition to attract a broad base of institutional and retail investors.

4. Underwriters: Leading investment banks, including Goldman Sachs, Morgan Stanley, and JPMorgan Chase, are underwriting the IPO. Their involvement underscores the confidence of financial experts in Emcare’s growth potential.

Strategic Importance of the IPO

The IPO represents a strategic milestone for Emcare, carrying several implications for the company and its stakeholders:

1. Access to Capital: The primary motivation behind the IPO is to raise capital. These funds will enable Emcare to invest heavily in its R&D pipeline, ensuring the continued development of innovative drugs. Access to public markets also provides a platform for future fundraising endeavors.

2. Market Visibility: Going public significantly enhances Emcare’s visibility in the market. It attracts attention from a broader range of investors, analysts, and potential partners, thereby increasing its credibility and market reach.

3. Employee Incentives: An IPO often includes stock options or share allocations for employees, which can serve as powerful incentives. This aligns the interests of employees with those of shareholders and can drive higher productivity and innovation.

4. Strategic Flexibility: With additional capital and market visibility, Emcare gains greater strategic flexibility. This includes the ability to pursue mergers and acquisitions, enter new markets, and invest in cutting-edge technologies.

The Market Context

The pharmaceutical industry is characterized by rapid advancements and a relentless pursuit of innovation. The global market is expected to grow at a compound annual growth rate (CAGR) of 5-6% over the next decade, driven by factors such as aging populations, increased prevalence of chronic diseases, and advancements in biotechnology.

1. Aging Population: The global population is aging, leading to an increase in age-related diseases such as Alzheimer’s, cardiovascular diseases, and cancer. This demographic shift creates a growing demand for effective treatments and healthcare solutions.

2. Chronic Diseases: The prevalence of chronic diseases, including diabetes, hypertension, and autoimmune disorders, continues to rise. Pharmaceutical companies like Emcare are at the forefront of developing therapies to manage and treat these conditions.

3. Biotechnology Advancements: Advances in biotechnology, including gene therapy, personalized medicine, and immunotherapy, are revolutionizing the pharmaceutical industry. Emcare’s focus on cutting-edge research positions it well to capitalize on these trends.

4. Regulatory Environment: The regulatory environment for pharmaceuticals is stringent, with rigorous approval processes. However, recent efforts to streamline regulatory pathways and expedite approvals for breakthrough therapies are creating new opportunities for companies like Emcare.

Investor Perspective

From an investor’s perspective, Emcare’s IPO presents both opportunities and risks. Here are some key considerations:

1. Growth Potential: Emcare’s strong pipeline and track record of successful product launches suggest significant growth potential. Investors are attracted to the company’s ability to innovate and bring new drugs to market.

2. Market Position: Emcare’s strategic focus on niche therapeutic areas with high unmet needs gives it a competitive edge. This positioning can lead to sustainable revenue growth and market share expansion.

3. Financial Health: Investors will closely scrutinize Emcare’s financial health, including revenue growth, profit margins, and cash flow. The company’s ability to effectively manage costs and maintain profitability will be crucial.

4. Risk Factors: Like any investment, Emcare’s IPO comes with risks. These include regulatory risks, competition from other pharmaceutical companies, and the inherent uncertainties of drug development. Investors must weigh these risks against the potential rewards.

Conclusion

Emcare Pharmaceutical Company’s IPO marks a significant milestone in its journey towards becoming a leading player in the pharmaceutical industry. The funds raised will enable Emcare to accelerate its research and development efforts, expand its market presence, and bring innovative therapies to patients worldwide. For investors, the IPO presents an opportunity to participate in the growth of a dynamic and forward-thinking company.

As Emcare embarks on this new chapter, its commitment to improving patient outcomes and advancing medical science remains unwavering. The IPO is not just a financial event; it is a testament to Emcare’s dedication to making a meaningful impact on global health. The road ahead is promising, and the world will be watching as Emcare continues to innovate and transform the future of healthcare.

Disclaimer

The information provided in this blog is for informational purposes only and should not be considered financial or investment advice. Investing in stocks, including IPOs, involves risks, and readers should conduct their own research or consult with a financial advisor before making any investment decisions. The author does not hold any responsibility for financial losses incurred due to investment actions taken based on the information provided in this blog.