“India tightens power export rules, safeguarding energy security amid Bangladesh’s electricity crisis. Learn how these strategic changes impact the region, with a focus on Adani Power’s Godda plant and its implications for India-Bangladesh relations.”

Introduction:

India’s recent amendments to power export regulations represent a calculated move that underscores its strategic interests in South Asia, particularly in the context of its energy relationship with Bangladesh. As the region grapples with political uncertainty and energy crises, these changes are poised to have significant implications for both countries and major industry players like Adani Power. Here’s a deep dive into the key aspects of this development.

The New Rules: A Strategic Hedge

On August 12, 2024, India introduced amendments to its power export guidelines, allowing power-exporting companies to redirect electricity back to the Indian grid under specific conditions. This is particularly relevant if the importing country, such as Bangladesh, fails to utilize the full capacity of the power plant or defaults on payments. The amendment serves as a protective measure against political and economic uncertainties, especially in light of recent turmoil in Bangladesh.

This change is a response to potential risks, including the recent political instability in Bangladesh following the ousting of Prime Minister Sheikh Hasina. Given that Bangladesh imports a significant portion of its electricity from India—largely from the Adani Group’s Godda power plant—this amendment is seen as a safeguard to ensure that Indian companies are not left vulnerable to external disruptions.

The Godda Project: A Pillar of India-Bangladesh Energy Ties

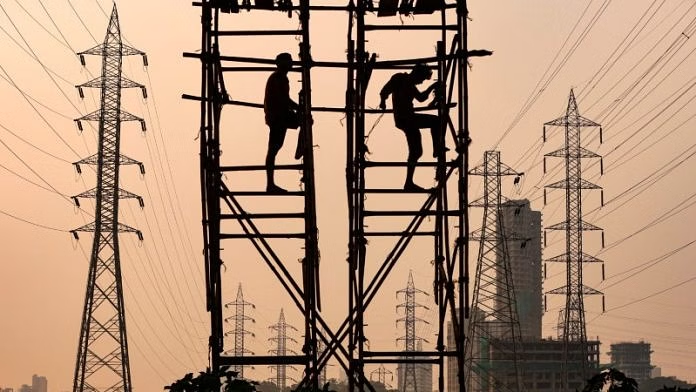

At the heart of this development is the Godda Ultra Super-Critical Thermal Power Plant in Jharkhand, operated by Adani Power. This plant, with a capacity of 1,496 megawatts (MW), is a critical component of Bangladesh’s power supply, providing over 6% of the country’s total electricity needs. The plant is India’s first transnational power project, where 100% of the electricity generated is exported to Bangladesh under a 25-year Power Purchase Agreement (PPA) signed in 2017.

However, the project has not been without controversy. Critics have pointed out the high costs associated with the imported coal used at the Godda plant, which is sourced from Australia’s Carmichael mine. This has led to higher electricity tariffs for Bangladesh, sparking demands from the Bangladesh Power Development Board (BPDB) for a revision of the PPA to lower costs.

Bangladesh’s Energy Woes: Dependence on Indian Power

Despite substantial progress in expanding electricity access, Bangladesh continues to face significant challenges in meeting its energy demands. The country’s reliance on imported energy, particularly from India, is a direct result of its underutilized domestic capacity due to fuel and gas supply constraints. In the fiscal year 2022-2023, Bangladesh imported 2,656 MW of electricity from India, with more than half of this coming from the Godda plant alone.

The recent political upheaval in Bangladesh, marked by the departure of Sheikh Hasina from office, has only exacerbated concerns about the stability of this energy partnership. The new power export rules introduced by India appear to be a preemptive measure to protect against potential disruptions that could arise from such political shifts.

The Adani Factor: Navigating Uncertainty

The amendments to India’s power export regulations could be seen as particularly beneficial to the Adani Group, which has a vested interest in ensuring the stability of its power supply agreements. The ability to reroute power to the Indian grid provides a critical safety net for Adani, especially in the event of payment delays or reduced power offtake by Bangladesh.

However, the broader implications of these changes extend beyond any single company. By tightening control over its power exports, India is also enhancing its strategic leverage in the region. Bangladesh, facing its worst electricity crisis since 2013, remains heavily reliant on Indian power. This dependency gives India a significant strategic edge, though it also raises questions about the sustainability of such arrangements in the long term.

The Road Ahead: Implications for South Asia

As India continues to assert its influence in South Asia, the recent amendments to its power export rules reflect a broader strategy of economic and geopolitical security. While these changes provide a safeguard for Indian companies, they also underscore the deep interdependencies that characterize the region’s energy landscape.

For Bangladesh, the amendments signal a need to reassess its energy strategy, particularly its heavy reliance on imported power. The ongoing political and economic uncertainties in Dhaka only add to the complexities of this relationship, making it crucial for both countries to navigate these challenges carefully.

conclusion:

India’s decision to amend its power export rules is a calculated move that highlights the intricate balance of energy, economics, and geopolitics in South Asia. As the situation unfolds, it will be critical to monitor how these changes impact not just India and Bangladesh, but the broader dynamics of the region.

Disclaimer:

The information presented in this blog is based on current reports and developments as of August 2024. While every effort has been made to ensure accuracy, the content may not reflect the most recent changes or official positions. The opinions and interpretations expressed are those of the author and do not necessarily represent the views of the companies or governments mentioned. Readers are encouraged to consult official sources or seek professional advice for specific concerns or decisions related to the topics discussed.